20+ mortgage tax credit

PMI is calculated as a. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

6 Budget Constraint For A 25 Year Old Single Adult On Jsa With A Mortgage Download Scientific Diagram

Special Offers Just a Click Away.

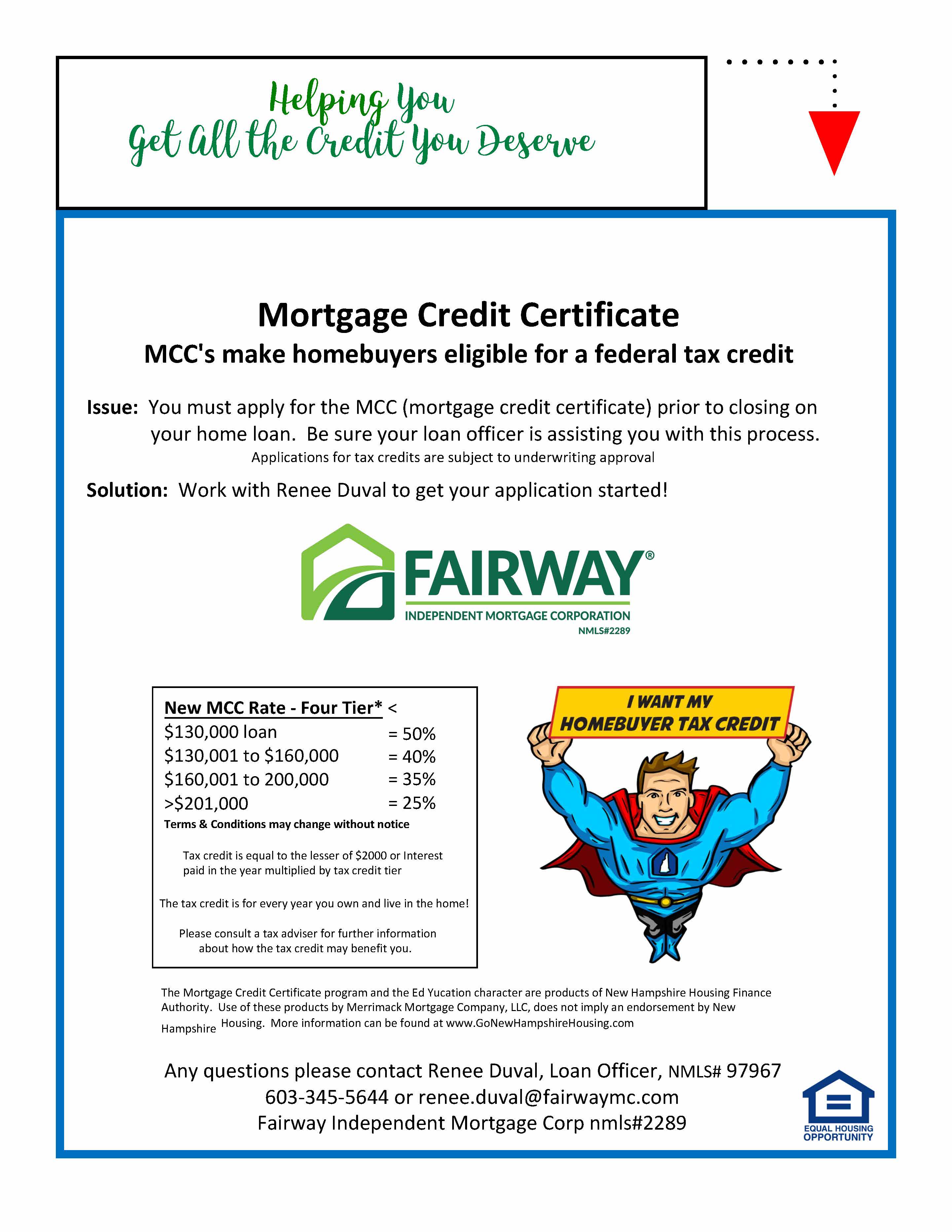

. Web The Mortgage Credit Certificate MCC program allows qualified homebuyers to claim a tax credit on their federal income tax returns equal to 10 to 50 of the. Web A mortgage calculator can help you determine how much interest you paid each month last year. Is The Mortgage Credit Certificate Worth It.

Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Mortgage Credit Certificate Number Issue date. Have an unused credit to carry forward to the next 3 tax years or until used.

Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Both programs were created to promote. Heres a list of the 20 popular ones and links to our other content that will help you learn more.

The amount you could save on your taxes with. Choose Smart Apply Easily. Verify Your Eligibility Today.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income. Homeowners who bought houses before.

The remaining annual interest is deducted from your gross income. Companies are required by law to send W-2 forms to. Web Tax Credits Child Tax Credit and Working Tax Credit.

Web There are hundreds of 2023 itemized deductions and credits out there. TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. This is less generous than the old system for higher-rate taxpayers who effectively.

Lets take a look at some of the pros and cons of using a mortgage. Ad Compare the Best Mortgage Lender To Finance You New Home. Your tax preparer calculates the annual.

Web The Mortgage Credit Certificate MCC program provides housing assistance by issuing a federal tax credit to first-time homebuyers statewide and repeat homebuyers in targeted. This means money back on your taxes that could be as much as 60000 on. Way to improve your chances of being accepted for a.

Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage. However higher limitations 1 million 500000 if married. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Businesses Can Receive Up to 26k Per Eligible Employee. Web Mortgage interest. All of the rental income you earn will be taxable and youll instead receive.

Which is the upper limit of the basic tax rate of 20. Web Name of Issuer of Mortgage Credit Certificate. Web How to Claim 20 Mortgage Interest Tax Credit Posted 36 minutes ago by Alex Im completing my 21-22 Self Assessment and have given the annual amount for my.

That cap includes your existing mortgage balance one vacation or second. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web If you receive a 20 MCC then youll receive a 1600 tax credit.

Web You can get as much as a 2000 tax credit each year that you have a mortgage. Web This MCC Program enables qualified first-time homebuyers to convert a portion of their annual mortgage interest into a direct dollar-for-dollar tax credit on their US. Web A Mortgage Credit Certificate MCC gives homebuyers in San Francisco a tax credit of 15 their mortgage interest.

Web The cost of private mortgage insurance ranges depending on the particular lender and how much money you actually put down on the loan. Web The California Tax Credit Allocation Committee CTCAC administers the federal and state Low-Income Housing Tax Credit Programs. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Instead you now receive a tax-credit based on 20 of your mortgage interest payments. Per the IRS you can deduct home mortgage interest on the first 750000 of your loan or 375000 if married and filing separately. You can claim a tax deduction for the interest on the first 750000.

Ad Taxes Can Be Complex. Web For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. Web A mortgage credit certificate is a federal tax credit for homeowners that can help them save on their yearly tax bills.

How Much Can Homeowners Really Save At Tax Time Find My Way Home

Home Buyer Tax Credit In Nh

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

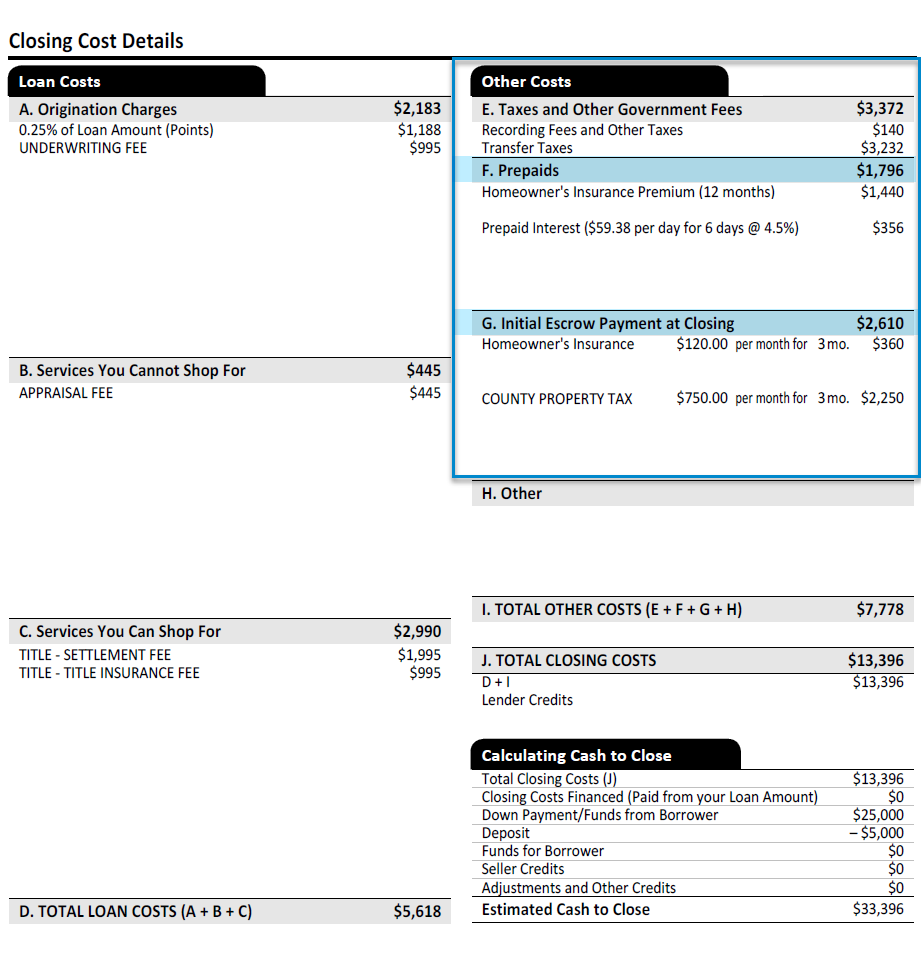

How Much Are Prepaid Items Mortgage Escrow

Region 5 Mortgage Bingo Card

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

Master Your Mortgage For Financial Freedom By Robinson Smith Ebook Scribd

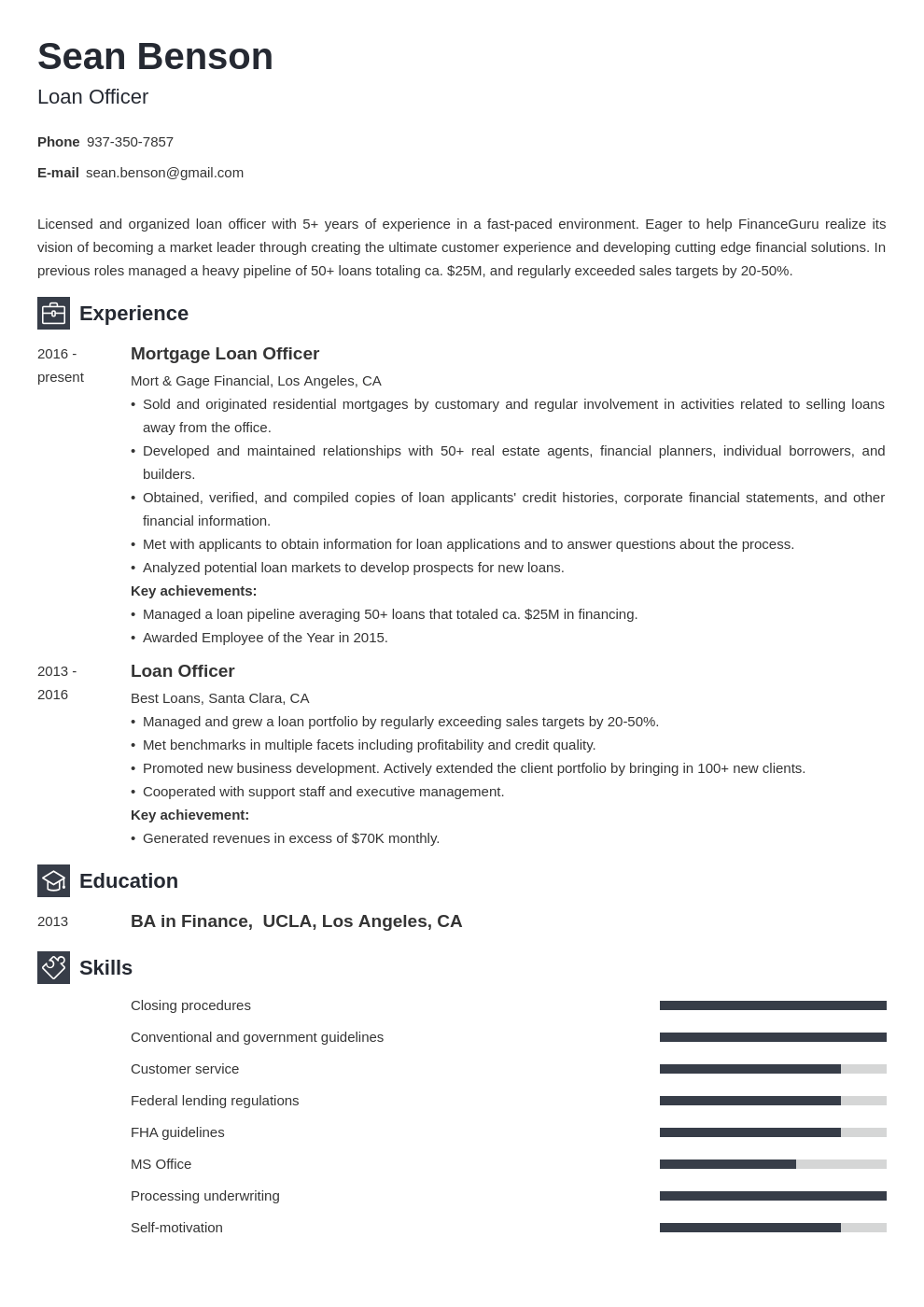

Loan Officer Resume Sample With Job Description Skills

All Citizens Tax Prep Checklist 2017

2 To 4 Unit Home How To Buy A Multi Unit Property

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

How Effective Tax Rate Is Calculated From Income Statements

Jobless Americans Face Unemployment Benefit Cuts In More Than 20 States Forbes Advisor

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

What Is The Argument For The Salt Tax Deduction Quora

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget